In the rapidly evolving landscape of financial markets, a compelling paradigm shift is taking place with the rise of socially responsible investing (SRI). More than just a financial strategy, SRI represents a conscious decision by investors to go beyond traditional profit motives and consider the broader impact of their investments on society and the environment. At its core, socially responsible investing seeks to align financial goals with ethical and social values, sparking a surge in interest among those eager to wield their investments as instruments of positive change.

As we delve into the intricacies of this transformative approach, we will unravel the concept of what is socially responsible investing, shedding light on the principles that guide to socially responsible investing and the factors that set it apart from conventional investment strategies. Join us on this exploration of SRI as we navigate through the diverse array of socially responsible investment funds and explore concrete examples of socially responsible investments. The landscape of ethical finance is vast and dynamic, and understanding its nuances is crucial for investors looking to make meaningful contributions to both their portfolios and the world at large.

Socially Responsible Investing (SRI) merges financial acumen with ethics, departing from traditional notions. It prioritises a conscientious evaluation of a company's societal and environmental impact, going beyond financial returns. SRI investors support businesses committed to ethics, sustainability, and positive societal contributions, guided by environmental, social, and governance (ESG) criteria. This deliberate departure from a profit-driven mindset opens a dialogue between investors and companies, transcending traditional dynamics. As SRI reshapes the investment landscape, it reflects a principled choice for a new generation of investors seeking a blend of financial prosperity and positive societal change.

In the realm of socially responsible investing (SRI), the spotlight falls on socially responsible investment funds, which play a pivotal role. Comprising mutual funds and exchange-traded funds (ETFs), these funds harmonise financial objectives with ethical and sustainable principles. Embracing the belief that capital possesses the power to instigate positive change, they rigorously vet companies against predefined environmental, social, and governance (ESG) criteria. Investors are presented with a diverse array of funds, each distinguished by its unique approach, whether it be sector-specific or adopting a comprehensive strategy. The allure of these funds transcends mere financial returns; they furnish investors with a sense of satisfaction by aligning their portfolios with ethical principles. As we delve deeper into this landscape, the narrative unfolds, elucidating how these funds serve as catalysts for transformative change, steering businesses towards a more sustainable and responsible future.

In finance, socially responsible investments (SRIs) go beyond profits, representing a deliberate choice to align capital with ethical values. Unlike traditional approaches, SRIs add scrutiny, ensuring funds contribute to positive societal and environmental outcomes. Diverse investment options let individuals tailor portfolios to values—supporting renewable energy, fair labour, or diversity. Screening for SRIs centres on environmental, social, and governance (ESG) criteria, guiding investors toward responsible practices. Beyond morals, SRIs foster a sense of impactful investing. Engaging in socially responsible investing (SRI) offers investors the chance to impact both portfolios and the world positively. Integrating environmental, social, and governance (ESG) principles into strategies becomes increasingly advantageous as global focus on sustainability grows.

In the pursuit of aligning investments with ethical values, investors often focus on socially responsible companies to invest in. These businesses serve as beacons, embodying a commitment to environmental stewardship, social responsibility, and ethical practices. Criteria for identifying them go beyond financial metrics, encompassing factors like carbon footprint and commitment to diversity. From renewable energy pioneers to those championing fair labour, socially responsible companies often lead in both financial performance and positive impact. Investing in them allows individuals to support businesses that share their values, wielding financial influence for positive change. Join us in exploring companies that exemplify ethical practices, showing that profitability and positive societal impact can coexist.

In finance's changing landscape, socially responsible investing companies have emerged as key players. Specialising in aligning financial goals with ethical considerations, these firms provide tailored solutions rooted in SRI principles. Acting as custodians of a values-driven approach, they curate investments based on rigorous environmental, social, and governance (ESG) criteria, offering diverse products from mutual funds to personalised advisory services. Through in-depth research, SRI companies identify options promising both financial returns and positive societal and environmental impact.

Embarking on the SRI journey, investors can benefit from the expertise of these firms, exploring how they seamlessly integrate ethics into investment strategies. Join us in discovering companies that transcend traditional finance, proving ethical investing is a transformative force shaping the future.

Socially responsible investing (SRI) has gained momentum not only as a moral imperative but also as a strategy that offers a range of tangible benefits to investors. As individuals increasingly seek to align their portfolios with their values, the pros of socially responsible investing become apparent, promising a dual return on investment that encompasses financial gains and positive societal impact.

Socially responsible investing (SRI) has gained momentum not only as a moral imperative but also as a strategy that offers a range of tangible benefits to investors. As individuals increasingly seek to align their portfolios with their values, the pros of socially responsible investing become apparent, promising a dual return on investment that encompasses financial gains and positive societal impact.

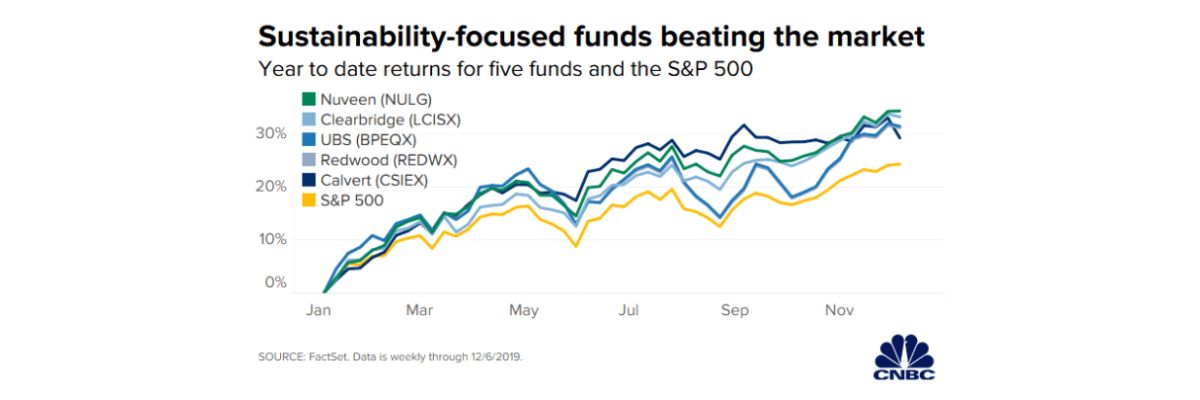

Contrary to the myth that ethical investing sacrifices returns, numerous studies suggest that companies with strong environmental, social, and governance (ESG) practices often outperform their counterparts over the long term. Investing in socially responsible companies may contribute to robust financial performance and long-term sustainability.

Socially responsible investing involves a comprehensive evaluation of a company's ESG practices. By considering factors such as environmental impact, social responsibility, and ethical governance, investors can potentially mitigate risks associated with issues such as regulatory scrutiny, reputational damage, and environmental liabilities.

Companies with strong ESG practices are often better positioned to navigate evolving market dynamics and regulatory landscapes. Socially responsible investing, with its emphasis on sustainability, may contribute to the long-term viability of both individual companies and the broader market. SRI allows individuals to align portfolios with values, supporting businesses prioritising sustainability and ethical practices. It acts as a catalyst for corporate change, creating a demand for ethical behaviour and prompting companies to enhance their sustainability initiatives.

While socially responsible investing (SRI) offers a myriad of benefits, it is essential to acknowledge the potential challenges and criticisms associated with this approach. Understanding the cons of socially responsible investing is crucial for investors seeking to make informed decisions that align with both their financial goals and ethical principles.

One of the criticisms of socially responsible investing is the potential for limited diversification. Some argue that by excluding entire industries or companies based on ethical criteria, investors may miss out on opportunities for broader diversification, potentially exposing their portfolios to higher levels of risk.

The absence of standardised criteria for what qualifies as socially responsible can be a drawback. Without clear and universally accepted guidelines, investors may find it challenging to evaluate the ethical practices of companies consistently. The subjective nature of ethical considerations may hinder the broader impact of SRI strategies, as they might not effectively address underlying structural issues within industries, limiting their ability to drive meaningful systemic change.

Greenwashing refers to the practice of companies portraying themselves as more environmentally friendly or socially responsible than they are in reality. Some critics argue that, in the absence of standardised reporting, companies may engage in greenwashing, making it difficult for investors to discern the true nature of a company's practices.

While research suggests that socially responsible investments can perform well financially, critics argue that the exclusion of certain industries or companies may limit potential returns. Some industries traditionally considered non-compliant with ESG criteria, such as fossil fuels, may have high financial returns, and avoiding them could impact overall portfolio performance.This selectivity may limit investment opportunities compared to traditional portfolios, exposing investors to higher risk and potentially impacting overall returns.

Socially responsible investing has emerged not only as a powerful financial strategy but also a catalyst for positive change. As we conclude our exploration of the pros and cons of socially responsible investing, it becomes evident that this approach represents a harmonious marriage of financial acumen and ethical principles. The benefits of socially responsible investing, from potential financial outperformance to the tangible impact on societal and environmental issues, underscore its transformative potential.

In the realm of socially responsible investing, the journey is as significant as the destination, with each investment choice shaping the trajectory of industries and influencing the future. Socially responsible investing stands poised as a beacon guiding the way to a future where profit and purpose coexist, fostering a global financial ecosystem that benefits both investors and the world at large.

By Frederica/Nov 09, 2024

By Lucy Lee/Mar 25, 2024

By Pamela Andrew/Apr 02, 2025

By Noah Jones/Oct 21, 2024

By Celia Kreitner/May 27, 2025

By Lucy Lee/Apr 25, 2024

By Alice Ellis/Feb 17, 2024

By Mark Allen/Apr 03, 2024

By Vicky Louisa/Apr 02, 2025

By Frederica/Nov 09, 2024

By Eleanor/Feb 11, 2025

By Peter Evans/May 13, 2024