Exploring the sphere of student loans can be intimidating, particularly when you factor in the burden of programs that forgive these loans. Regrettably, such programs are becoming more common and this has resulted in a growth of scams related to forgiving student debts. These deceptive strategies frequently target clueless borrowers searching for help with their financial obligations. In this article, we will be investigating the way these deceptions function. We'll also delve into the usual methods employed by deceitful individuals and provide useful techniques to steer clear from becoming prey to financial aid scams.

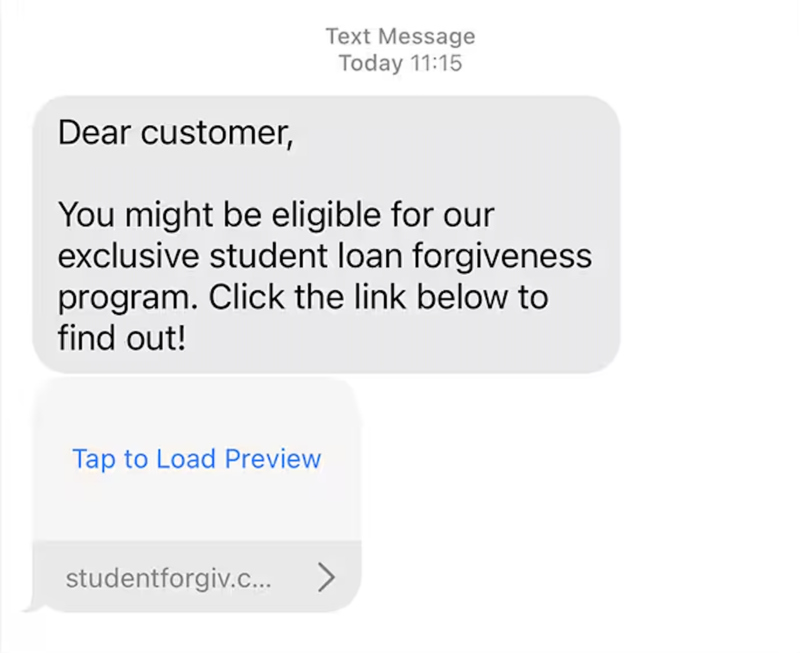

To avoid scams related to student loan forgiveness, it is crucial to understand the strategies used by fraudsters. Quite often, these people or groups will employ forceful marketing methods such as unexpected phone calls, emails, or messages through social media claiming that they can assure a cancellation of your loans. They might guarantee quick relief from debt and propose you should pay them for access to government services which are usually available without any charges. Recall that true forgiveness programs usually do not ask for any advance payment. By learning these strategies, you can stay alert and sidestep fraud.

People who carry out scams can pretend to be government bodies or real financial firms so they seem more trustworthy. They may use words and symbols that sound and look official, building a pretense of being proper which people might believe in. Also, to attract possible victims even more, they could offer untrue testimonials or reviews. It is very important to always know about usual scams because being aware can greatly decrease the chance of becoming a victim of dishonest tricks.

To keep safe from student loan fraud, it's crucial to study genuine loan pardon programs provided by the U.S. Department of Education. Programs like Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness are made to help borrowers who fulfill certain conditions. It is important to look over the qualification needs and comprehend how you apply for these programs. Sources you can trust for information are official sites from the government and respected financial aid resources. Understanding all aspects of these programs is useful in identifying if scammers target you.

A good number of provinces and learning establishments also provide their unique debt-pardon programs that might not be broadly promoted. Exploring regional possibilities can give you more ways for financial support tied to your profession or area. Moreover, knowing the schedule and documents necessary for forgiveness applications will assist you in identifying if a person is aiming to deceive you regarding your choices.

If a business comes to you promising assistance with student loan forgiveness, their credentials must be checked. Real student loan services and nonprofit organizations would have an obvious and established presence. Their reputation can be verified via the Better Business Bureau or by reading feedback on the internet from other borrowers. Also, be careful with the organizations that seek your data, like your Social Security number or banking account details, specifically if they reach out to you initially. The safeguarding of your individual information is crucial in steering clear of scams related to student loan forgiveness.

You may find it beneficial to talk with close friends or family who might have encountered similar situations. They could provide advice or recommend trustworthy services that were successful for them. If you ever feel unsure, do not hesitate to contact your student loan service provider directly about any organization trying to communicate with you.

As someone who has borrowed money, there are particular rights available to you under the law of the nation that act as shields against deceit linked to financial aid. The Federal Trade Commission (FTC) offers advice about your entitlements related to student loans. For example, it is within your right to see information regarding your loan and argue any fees that seem not approved by you. Knowing these rights can give you the confidence to act if you think fraud is happening. Also, informing about doubtful activities to FTC or the attorney general of your state can stop others from becoming prey to alike scams.

A lot of people who have borrowed money are not aware that they can ask for more detailed information about the terms and conditions of their loan from the person servicing it. This clearness is very important to see if there are any differences or wrong information given by potential cheaters. If you take action to understand your rights, this will strengthen your protection against false charges.

People who do scams usually use intense selling strategies to make people feel rushed, forcing them to decide quickly. They might say that offers that are only available for a short time or future policy changes mean you have to act right now. You mustn't rush into anything and evaluate the circumstances before answering any requests. Real companies will not hurry you into determining your financial future. Spend time to investigate, ask about, and involve reliable finance advisors if needed. By shunning high-stress circumstances, you can safeguard yourself from possible fraud.

Understanding that genuine financial guidance is usually provided without force can be a crucial difference to note. Always permit yourself the time needed to examine any proposals or contracts comprehensively before signing anything. Adopting this manner doesn't just safeguard your monetary interests but also assists you in keeping command over your choices.

When you are trying to understand the complications of student loans, many resources and support systems can assist you. Think about contacting the financial aid office at your school for advice. They have precise information about student loans and any programs that might help forgive these debts which you may be eligible for. Furthermore, there are charitable organizations that focus on educating people about student loans and they can lend a helping hand. If you interact with these resources, your comprehension of your student loan situation could improve considerably. This boosts your capability to make knowledgeable choices and safeguards you against becoming prey to fraudulent schemes.

Many internet platforms and discussion areas supply important understandings and experiences from other people who have borrowed. Using these groups can assist you in collecting real-life details and advice on how to successfully handle student loans. Making contact with persons that experienced similar situations can offer comfort as well as more information to prevent fraud.

To better preserve your financial future, it is important to understand how you can stay clear of student loan forgiveness scams. It helps if you know the usual strategies used in these frauds and research valid programs for reference. Check on company credentials, be aware of your rights, do not submit to high-pressure situations, and make use of resources that are at your disposal, all these steps will significantly aid in protecting yourself from deceitful acts. Maintaining alertness by being informed enables a confident venture into the terrain of student loans.

By Frederica/Mar 12, 2024

By Alice Ellis/Mar 14, 2024

By Eleanor/Oct 17, 2024

By Sid Leonard/Jun 17, 2025

By Peter Evans/Apr 24, 2024

By Frederica/Feb 12, 2025

By Triston Martin/Jun 25, 2025

By Eleanor/Oct 29, 2024

By Frederica/Feb 21, 2024

By Darnell Malan/Oct 13, 2024

By Noah Jones/Oct 21, 2024

By Lucy Lee/Apr 13, 2024