In the dynamic world of finance, the question of investment addiction has been brought forward due to the allure of investing has captivated the minds of many, promising a path to financial prosperity and security. Yet, amid the charts, numbers, and potential gains lies a question that often goes unexplored: Can one become addicted to investing? As the popularity of financial markets continues to soar, the lines between calculated strategy and compulsive behaviour may blur.

In this exploration of the captivating world of investment, we delve into the concept of investment addiction—examining its existence, the signs that may indicate its presence, and the impact it can have on individuals navigating the ever-changing landscape of financial markets. From the adrenaline-inducing highs to the shared experiences on platforms like Reddit, we aim to unravel the complexities surrounding the question Can you truly become addicted to investing?

At its core, investing beckons with a tantalizing promise — the potential for financial growth, independence, and a secure future. The allure of transforming hard-earned money into a wealth-generating machine instills a sense of control over one's financial destiny. The excitement of identifying lucrative opportunities, the adrenaline rush of well-timed decisions, and the vision of a prosperous future create a captivating narrative that draws individuals into the enthralling world of finance.

However, this enchanting allure is not without its complexities. The fear of missing out (FOMO) on the next big investment opportunity can act as a powerful motivator, propelling both novice and seasoned investors to actively participate in the ever-evolving financial markets. As dreams of financial freedom and success fuel this allure, it becomes evident that this journey can take unexpected turns, leading some down a path marked by addictive tendencies that merit careful consideration.

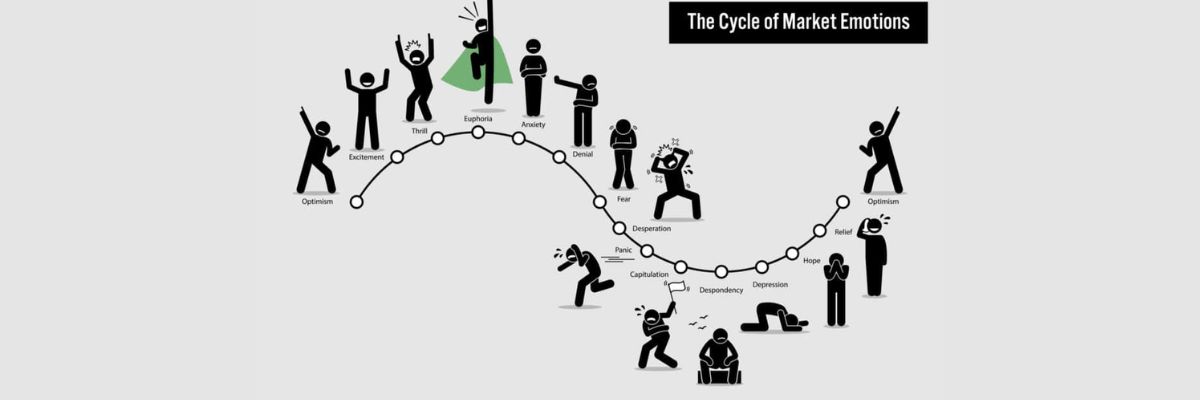

Traditionally, addiction has been linked to substances, but its tendrils extend into various aspects of human behavior, including investing. This raises the pertinent question: "Is Investing Addictive?" The allure of potential gains and the omnipresent FOMO create an environment ripe for addictive behavior. The highs of successful investments and the lows of losses contribute to an emotional rollercoaster that some find difficult to resist.

Online forums, such as Reddit, serve as a platform for investors to share their experiences, with threads like "Addicted to Investing" shedding light on the intricacies of this phenomenon. The continuous quest for the next big opportunity and the compulsive need to monitor market movements suggest that, for some, investing transcends a mere strategic financial pursuit to become a potentially addictive behavior that warrants scrutiny.

Online forums, such as Reddit, serve as a platform for investors to share their experiences, with threads like "Addicted to Investing" shedding light on the intricacies of this phenomenon. The continuous quest for the next big opportunity and the compulsive need to monitor market movements suggest that, for some, investing transcends a mere strategic financial pursuit to become a potentially addictive behavior that warrants scrutiny.

As we navigate the nuanced landscape of financial markets, it becomes essential to recognize the signs and implications of investment addiction to maintain a balanced and healthy approach to wealth creation. The intricate dance between the allure of investing and the emergence of addictive behaviors underscores the need for mindfulness and self-awareness in the pursuit of financial goals.

Recognizing the signs of investment addiction is paramount for individuals seeking to maintain a healthy relationship with financial markets. The following key indicators can serve as warning signs that you might be veering into addictive territory

In the realm of investing, the behaviour of compulsively checking market updates and stock prices throughout the day can serve as a red flag. This relentless monitoring is not just a routine check but may signify a deeper issue—an unhealthy obsession with the constant ebb and flow of financial markets. The indicator here is the perpetual need to stay informed about every market movement, suggesting a potential imbalance in one's relationship with investing.

Another critical aspect to consider is the behaviour of making investment decisions impulsively without the necessary research or analysis. The tendency to act on impulse becomes more pronounced when faced with market volatility. This impulsive behaviour may not only jeopardise the effectiveness of one's investment strategy but can also indicate a need for more rational decision-making. The indicator here is a potential emotional attachment to investment outcomes, where quick decisions are driven more by sentiment than a thoughtful analysis of the situation.

Investing often involves navigating a rollercoaster of emotions, but it raises concerns when these emotions become closely tied to investment outcomes. Experiencing intense highs with gains and devastating lows with losses may indicate a deeper emotional dependence on the performance of one's financial portfolio. The indicator is the significant impact that the success or failure of an investment has on one's overall mood, suggesting that emotions are driving investment decisions more than a calculated strategy.

Investing, when taken to an extreme, can lead to the neglect of other crucial aspects of life. If investing activities start to take precedence over work, relationships, or personal well-being, it becomes a behavioural concern. The indicator here is the imbalance created when pursuing financial success overshadows other essential life responsibilities. Recognizing this neglect is crucial in assessing whether investing has transitioned from a strategic financial endeavour to a potential addiction.

Recognizing these signs requires honest self-reflection. If you find yourself exhibiting multiple indicators, it's essential to reassess your approach to investing and consider seeking guidance to ensure a healthier and more sustainable financial journey. Balancing the excitement of investing with a rational and measured mindset is crucial for long-term financial well-being.

Engaging in thoughtful self-reflection is a crucial step for individuals who want to answer the question “Am I addicted to investing?” . Consider the following questions to assess your relationship with investing

Constant Urge to Invest

Constant Urge to InvestConsider the presence of a persistent and almost irresistible urge to invest, even when such impulses may not align seamlessly with your overarching financial strategy and goals. This introspection is crucial in evaluating whether the desire to invest has transcended rational decision-making, potentially indicating a more impulsive and emotionally driven approach to financial activities.

Engage in thoughtful reflection on the nature of your investment decisions. Assess whether your choices are predominantly steered by emotions rather than a rational analysis of market dynamics. An exploration of whether impulsive choices are made without conducting thorough research provides insight into the emotional undercurrents influencing your financial decision-making process.

Take stock of the alignment between your investing activities and your broader financial goals. Evaluate whether the pursuit of short-term gains has eclipsed your long-term financial strategy. This self-assessment aids in understanding the balance between immediate gratification and the sustained, strategic growth needed to achieve overarching financial objectives.

Consider the emotional resonance of your investment outcomes. Take note of whether successes evoke an extreme elation and whether losses plunge you into deep distress. This examination sheds light on the emotional ties binding your overall well-being to the performance of your financial portfolio.

Assess the impact of your commitment to investing on other facets of your life. Delve into whether your dedication to financial pursuits has inadvertently led to neglect in areas such as work, relationships, or personal well-being. Recognizing any imbalance is pivotal in determining whether your focus on investing has edged into a realm that may jeopardise essential life responsibilities.

Reflect on the frequency with which you find yourself monitoring market updates. Evaluate whether the need to stay constantly informed about market movements consumes a substantial portion of your time and mental bandwidth. This examination offers insights into the degree to which your daily life is intertwined with the ever-evolving dynamics of financial markets.

Gauge your ability to maintain a long-term perspective on your investments. Assess whether your approach is characterised by a patient, strategic outlook or if there's a consistent pattern of chasing short-term gains. This assessment aids in understanding the sustainability of your investment strategy and its alignment with your overarching financial objectives.

If your self-reflection reveals patterns aligning with the signs of investment addiction, it's essential to acknowledge these tendencies and consider seeking guidance. Whether through professional financial advice or support from peers, addressing addictive behaviours early can pave the way for a healthier and more sustainable approach to investing. Balancing the excitement of financial markets with a strategic, rational mindset is critical to ensuring a fulfilling and well-rounded financial journey.

In the fascinating world of investing, where fortunes are made and lost, it's crucial to acknowledge the fine line between strategic financial planning and potentially addictive behaviour. The allure of potential gains, the fear of missing out, and the emotional rollercoaster of market fluctuations can lead individuals into a realm where investing transforms from a calculated endeavour into a potentially harmful addiction. Recognizing the signs of investment addiction, such as obsessive monitoring, impulsive decision-making, and a neglect of other responsibilities, is the first step toward maintaining a healthy relationship with financial markets.

Engaging in self-reflection to assess your own behaviours and motivations is essential, as it allows you to make informed decisions aligned with your long-term financial goals. Striking a balance between the excitement of investing and a rational, measured approach is the key to ensuring a fulfilling and sustainable financial journey. By understanding the allure and potential pitfalls of investment addiction, individuals can navigate the complexities of financial markets with wisdom, prudence, and a commitment to their overall well-being.

By Peter Evans/Apr 12, 2024

By Frederica/Feb 21, 2024

By Lucy Lee/Feb 28, 2024

By Vicky Louisa/Nov 21, 2024

By Vicky Louisa/Apr 02, 2025

By Lucy Lee/Apr 28, 2024

By Frederica/Apr 01, 2024

By Kristina Cappetta/Apr 28, 2025

By Frederica/Apr 14, 2024

By Alice Ellis/Apr 02, 2024

By Susan Kelly/Feb 25, 2024

By Darnell Malan/Mar 17, 2025